SunGreen is happy to help you arrange the financing you need. We help you to achieve sustainability goals within your budget.

We get our commercial clients the best loan, lease or power purchase agreement for them. We work with many third parties that provide valuable services to meet that goal. SunGreen is not wedded to any financing partner. SunGreen gets no kickbacks or special arrangements.

Our first priority is getting you the best deal.

You have many financing options. There are many incentives that will enable your system to pay for itself even sooner. We're happy to answer questions anytime about what you qualify for.

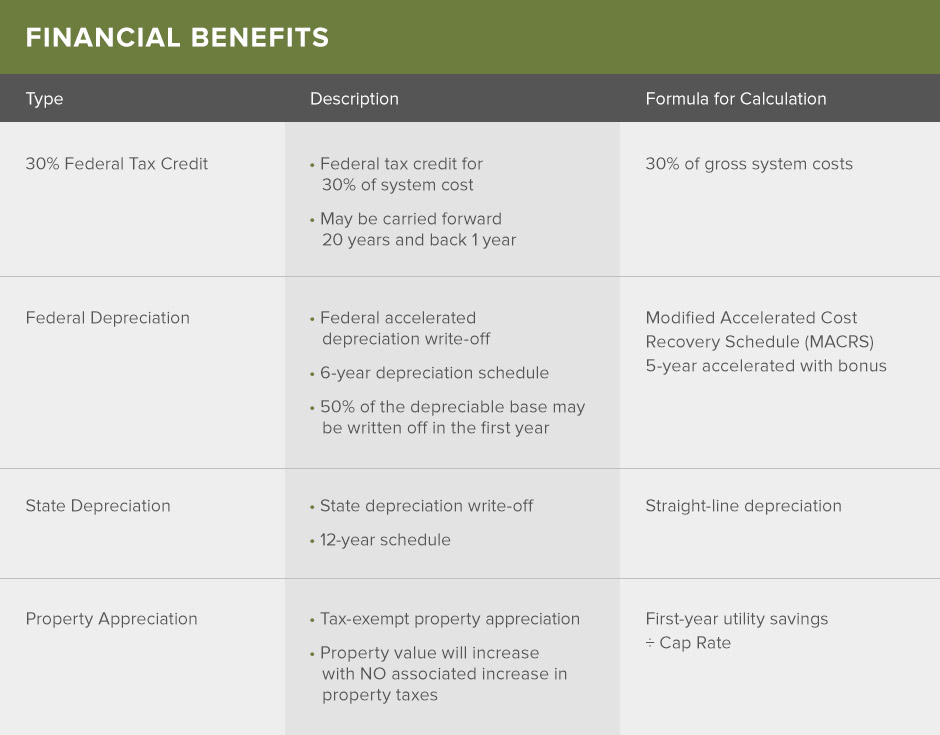

The federal Solar Investment Tax Credit gives you credit on your income tax return. This credit can be as much as 30% of the price of your system.

The California property tax exclusion for solar enables further benefits for your system. This exclusion can increase the value of your property without raising your property taxes.

Your project may also qualify for accelerated federal and state depreciation.

We'll help you take advantage of every incentive available to you.

|

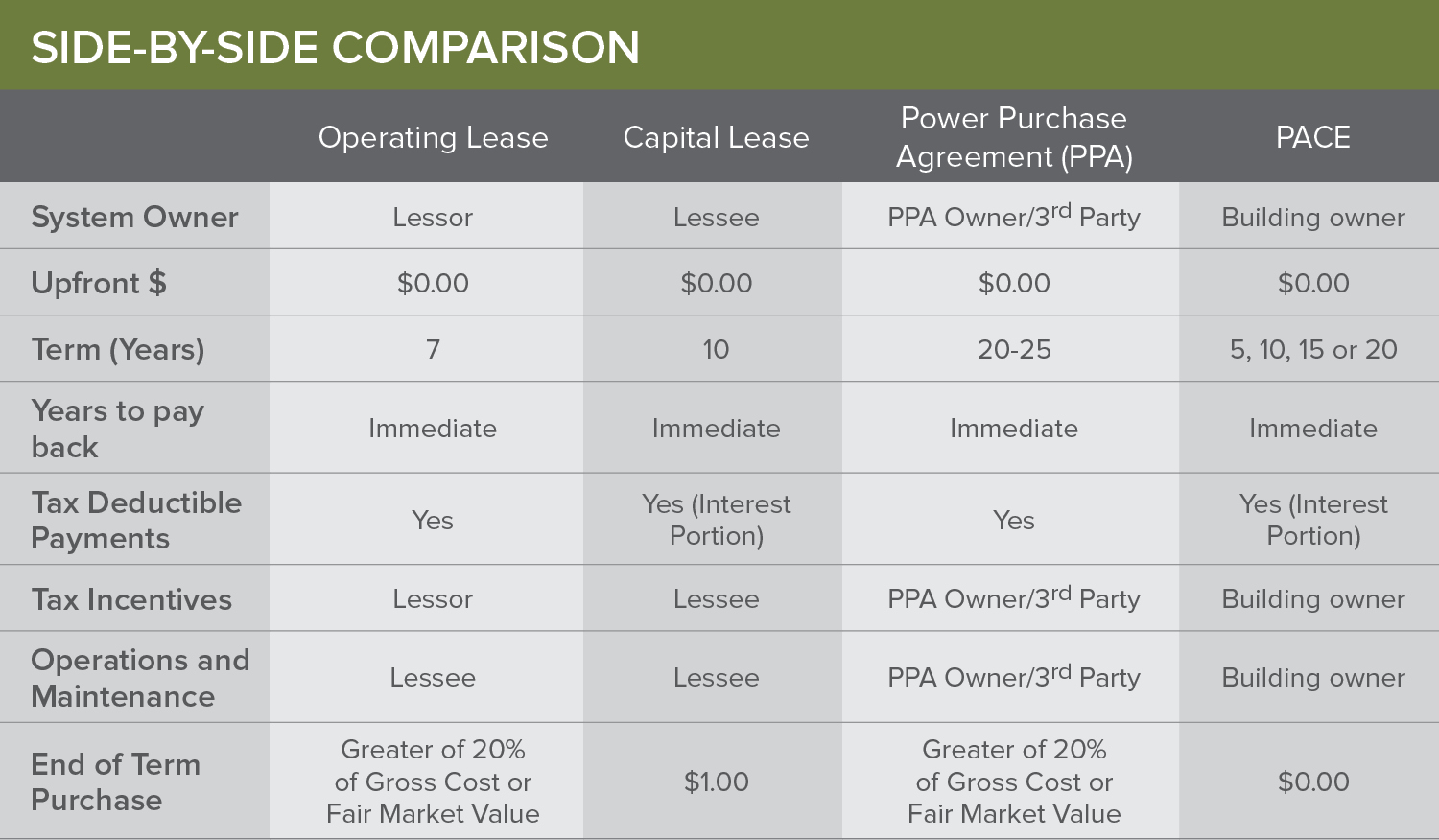

Turnkey Purchase Operating Lease Capital Lease |

PPA (Power Purchase Agreement) PACE (Property Assessed Clean Energy) |

With a PPA, a third party owns the system on your building. You lock in a predictable rate that's cheaper than power from the grid.

PPA can be a good option for those who don't have the resources for an outright sale. PPA can also be a good option for those who prefer to have someone else own and maintain their system. Such an arrangement can be simpler. As with a lease, the amount of your new monthly energy bill (including your monthly PPA payment) is likely to be less than your existing energy bill.

Property Assessed Clean Energy (PACE) financing programs offer loans for commercial energy products (not just solar). These are products permanently affixed to the property.

SunGreen Systems has helped many home and business owners take advantage of PACE financing.